A Guide to Doing Business in Sweden

Welcome to our Guide to Doing Business in Sweden. In our guide we cover the most relevant areas for anyone who is looking into entering the Swedish market. The guide is updated as per 2022.

Doing Business in Sweden

Table of contents

- About Sweden & Fast facts

- Why doing business in Sweden?

- Banking, currency and commercial legal aspects

- Business Entities

- Tax on income – Companies

- Tax on income – Individuals

- Other taxations

- Business administration

- Our company – Revideco AB

- Contact us

About Sweden

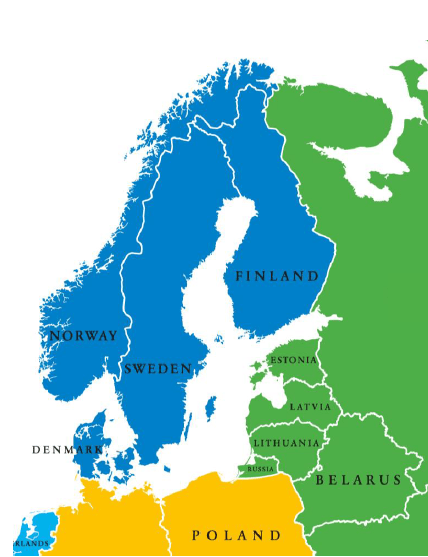

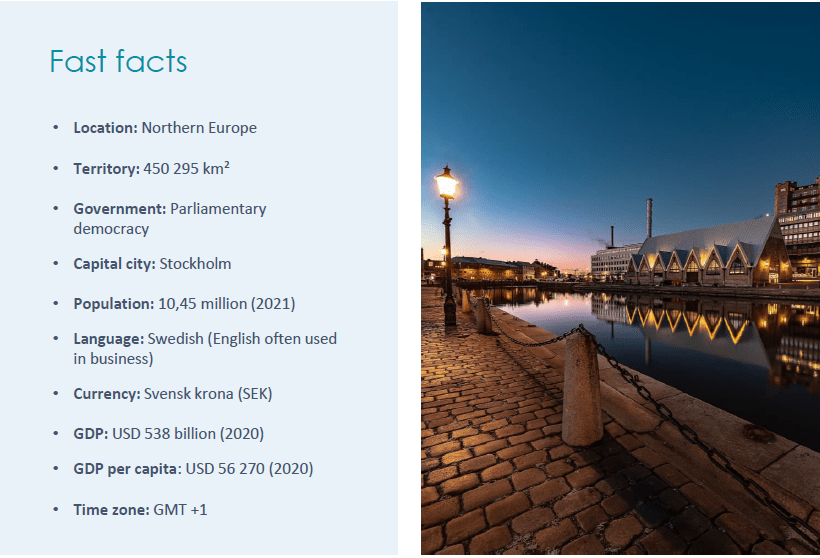

Sweden is the largest country in Northern Region, covering an area of 450 295 square kilometers, with a population of nearly 10,45 million people (2021).

Sweden is a constitutional monarchy with King Carl XVI Gustaf as head of the state. His authority is formal, symbolic and representational. Sweden is a parliamentary democracy and general elections are held every fourth year. Sweden has been a member of the European Union, EU, since 1 January 1995.

Sweden is however not a member of the European Currency Union (EURO).

Sweden’s capital city is Stockholm with a population of nearly 2 million people in the region. Other major cities include Gothenburg, Malmö and Uppsala. The country is bordered by the Baltic Sea, Finland to the East, Norway and Denmark to the West and Germany, and rest of Europe to the South. Swedes are known for their entrepreneurial spirit, high ability to innovate and their proneness to digitalization. Multi international companies such as IKEA, Spotify, Klarna, Izettle and H&M originates from Sweden.

Why doing business in Sweden

A focus on innovation, sustainability, co-creation and equality has created a highly dynamic economy in Sweden. This provides an excellent platform for companies to start and expand their businesses in an increasingly purpose-driven world.

High living standards

Sweden is one of the most developed post-industrial societies in the world, with high living standards and long life expectancy. Sweden is also top-ranked in areas such as business climate, sustainability, global competitiveness, language skills, productiveness and innovation – the latter with a performance well above EU average.

Equality and diversity

The Swedish society values openness, equality and diversity, which has created an environment where people dare to face risk and to innovate. A proof of that is Sweden’s long history of generating some of the world’s most successful industrial companies.

The Swedish people are generally well travelled and sees themselves as part of a global world. They enjoy challenges, because solving them increases competence and gives competitive advantage. It should also be noted that beneath their often time humble appearance, Swedes are curious, forward thinking doers.

The center of Scandinavia

Sweden’s location, in the center of Scandinavia, makes it possible to export and import goods to and from all European countries, with a potential reach to over 700 million consumers. Sweden´s major trade partners are, besides the Nordic countries, China, Germany, the Netherlands, the United Kingdom and the United States of America.

The global economic crisis, due to the Covid-19 pandemic, has so far had a limited impact on the Swedish business environment. The annual assessment of investment climate for foreign entrepreneurs is still continuously improving.

Combined with Sweden’s international safety, stability and membership in the EU, this makes Sweden a credible and important business partner for foreign investors.

Banking, currency and commercial legal aspects

Banking

Sweden’s central bank (Riksbanken) is a public authority under the Swedish parliament and is responsible for the monetary policy. The main objective of Riksbanken is to maintain a low and stable level of inflation. Riksbanken also has the task of ensuring that payments are made safely and efficiently.

Currency

The currency in Sweden is Svenska kronor, banking code SEK. Sweden turned down the EURO in a 2003 referendum, and has circumvented the requirement to adopt EURO by not meeting all of the convergence criteria.

Commercial legal Aspects

Government approval is not needed in most lines of businesses. An exemption to this is the field of financial and insurance services. These businesses need approval from the Financial Supervisory Authority (Finansinpektionen, FI).

The Swedish Competition Authority (Konkurrensverket) oversees that corporations adhere to the Competition Act. The act is nearly identical to the EC rules in order to make Swedish undertakings subject to the same set of rules. The act sets out a prohibition against anti-competitive co- operation and abuse of a dominant position.

The only restrictions in Swedish legislation on imports or exports are those applying within the European Union. However, in order to import certain commodities, e.g. agricultural and chemical products or textiles, a permit or an import license might be required. Other examples of goods for which permits are required are arms, hypodermic syringes and needles, pharmaceuticals, animals and plants of endangered species, wine and spirits.

In order to protect a patent, trademark, trade name or a design an application must be submitted to the Patent and Registration Office (Patent-och Registeringsverket or PRV) or any other relevant international authority.

Business Entities – Guide to doing business in Sweden

The principal forms of business entities in Sweden are:

Limited company

- The limited company (Aktiebolag, AB) is the most popular entity in A limited company is a legal entity with its own rights and responsibilities, which, for example, limits the owners’ liability for the company’s debts. There are two types of limited companies in Sweden, private and public. Starting a limited company in the European Economic Area (EEA) is a fairly straightforward process. The limited company is registered at Swedish Companies Registration Office (Bolagsverket) before business operations are commenced.

- A limited company can have a sole owner, but at least two individuals needs to be registered on the company and a minimum starting capital of 25,000 Swedish kronor (SEK) is required.

- The easiest and most common way to set up a private limited liability company in Sweden is to use an “off-the-shelf”-solution provided by a company agent or a law firm. Many business services firms have this readily available, enabling a fast start-up process. Using an off-the-shelf solution gives quick access to a brand new, pre-registered, limited liability company that has not previously traded or been engaged in commercial activity. The off-the-shelf solution means that the company can start business as soon as the share purchase agreement is signed, and the share capital (minimum SEK 25,000) is transferred to a bank account specially opened for the company. Once this is confirmed, a general power of attorney is received by the shareholders enabling them to act on the company’s behalf.

- A limited company must have at least one director and one deputy. If the board has more than one director, it must register a chairman of the board. Public companies must have at least three directors and a managing director, while a private company may appoint a managing director. The board of directors is elected annually by the shareholders at the general meeting. At least half of the board members and deputies must be residents of the EEA. The company must have one person living in Sweden who is able to receive information and is labelled agent for service of process.

- The following persons in a limited company must reside within the European Economic Area (EEA). The requirements concern residency, not citizenship.

- At least half of the board members

- At least half of the deputy members

- The managing director and all deputy managing directors

- At least one the persons who are authorized to sign on behalf if the company

- A limited company has to file an annual report at To close a limited company, it has to be sold or liquidated.

Sole proprietorship

Sole proprietorship (Enskild firma, EF) is the easiest way of forming a company. Special formalities, such as a partnership agreement or minimum capital as in limited company, are not required. The entity can be established by one person and is suitable for small businesses and start-ups as it is inexpensive and enables a quick establishment. However, there is no legal distinction between the owner (i.e. the sole proprietor) and the business. Therefore, the owner bears the responsibility of obligations and liabilities that occur during business operations.

Trading partnership

Trading partnership Handelsbolag (HB) consist of at least two partners. Partners share profits, managerial responsibilities and liability for debts equally. A trading partnership is a legal entity, but the partners are personally responsible for the partnership’s debts.

A trading partnership becomes a legal entity when it is registered at Bolagsverket. A legal entity may sign agreements, have employees, own assets and be a part in a legal trial. A person who wishes to be registered in a trading partnership cannot be declared bankrupt or prohibited from business operations or have a custodian pursuant to the Parental Code.

Limited Partnership

A limited partnership (Kommanditbolag, KB) consists of at least two partners. There are two types of partners: general and limited. A limited partnership is a form of a trading partnership. The general partner represents the company and runs the business. The limited partners have limited liability and is responsible for the obligations towards creditors up to an amount called limited partnership sum. The limited partner do not take part in managing the business.

Branch in Sweden

A foreign company wishing to operate in Sweden without registering a subsidiary may open a branch (Filial). A branch is a foreign company’s local office in Sweden with its own administration and corporate identity number. The branch separate accounting must be kept in accordance with Swedish accounting regulations and in Swedish language.

Economic Association

An Economic Association (Ekonomisk förening, EF) is a legal entity in which all members must participate in the economic activity of the association. An economic association must keep accounting records and issue an annual report. While there is no demand on starting capital, all members must pay membership fees when joining. The members have no responsibility for the association’s debts.

Tax on income – Companies

CIT – General

Sweden’s tax structure is transparent and efficient and designed to meet the needs of international investors. Companies can benefit from advantageous tax rules, favorable structures for holding companies and tax relief for key foreign employees.

CIT – Tax rates

The standard corporate income tax rate is 20,6% (2021).

CIT – Corporate Tax

A resident company is liable for national income tax on its worldwide profit, including capital gains. A company is generally only considered resident in Sweden if it is incorporated there. A non-resident company is liable for national income tax only on specified types on Swedish-source income and capital gains. Companies are allowed to make provisions to a tax allocation reserve (periodiseringsfond) of up to 25 % of taxable income. The provision must be dissolved (added to income) after six years.

Operating losses can be carried forward indefinitely. Losses may however not be carried back. There are restrictions for previous losses on the change of ownership.

Each company within a group constitutes a separate taxable entity. There is no taxation on the consolidated income of a Swedish group of companies, defined generally as a parent company and its’ 90 % or more owned subsidiaries. However, within the Group it is possible to pool profits and losses for tax purposes by means of a system of group contributions.

Dividends are in general subject to a withholding tax of 30 %. However, there is no withholding tax if the domestic exemption applies. Dividends paid to foreign unquoted companies can qualify for the exemption if the shares are held as business assets.

CIT- Transfer pricing

Swedish law in respect of transfer pricing is based on the so-called arm’s length principle. Under this principle, the Swedish Tax Agency may adjust the income of a Swedish limited liability company, if its taxable income in Sweden is reduced as a result of contractual provisions that differ from those that would be agreed by unrelated parties. Swedish limited liability companies are obliged to maintain transfer pricing documentation for cross-border transactions with affiliated parties.

Social security contribution

All employers are liable for the social security contributions of their employees. The standard rate is approximately 32 % of gross salary. Reduced rates are commonly used by the government to stimulate employment of the young, elderly and long-term unemployed people, and also so stimulate employment in economically troubled regions.

Employers who provide their employees with pensions must also pay a salary tax equivalent to 24.26 % of the expenses they incur.

Competitive Tax rules

- Sweden is among Europe’s most favorable jurisdictions for holding companies. Capital gain and dividends from business with related shares are exempted from

- The tax exemption applies to shares held in, or dividends received from, companies in Sweden and

- Low effective corporate tax rate 20,6 %.

- Interest is generally deductible for tax

- Losses can be carried forward indefinitely but may not be carried back.

- There is no withholding tax on interest

- Extensive double tax treaty network

- There is no legislation on thin-capitalization in

Income tax individuals

Individuals, who are liable to Swedish tax, have to pay tax on their worldwide income and capital gains. Taxable income includes all remuneration received from employers, whether in cash or in kind, such as free food, free accommodation, company cars etc. Pensions, unemployment benefits are also included in the taxable income. It is permissible to deduct certain costs from the income, e.g. travelling costs between work and home.

To be regarded as a resident for tax purposes, an individual must meet one of the following requirements:

- Live permanently and be domiciled by choice in Sweden.

- Have a habitual place of abode in Sweden

- Have an essential connection with Sweden

Normally a continuous stay of six months establishes a habitual place of abode in Sweden, which makes the individual resident from the first day.

Taxable income (SEK)

The tax rate of taxable income for individuals is depending on the annual income. The tax rate can various between 30-55 % of income (2021). The taxable income is adjusted every year according to the change of consumer price index.

Capital income

Capital income is taxed separately from income from employment at a rate of 30 % and is not subject to municipal income tax.

Capital income is comprised of interest, gains from the sale of capital assets, gains from the sale of real estate, dividends etc. Interest expenses and capital losses can be set off against capital income.

VAT

VAT is a tax on goods and services (indirect tax). Activities which are subject to VAT:

- import

- export

- sales (delivery) of goods and services

Real estate

The procedure is uncomplicated for investing in commercial and industrial property.

All properties are registered at the Swedish Cadastral and Land Registration Authority (Lantmäteriet). The registration includes title holder, plan and regulations, mortgages, easements, tax assessment and purchase price for the latest transfer.

VAT Rates

25% – standard rate of VAT

12% – rate applied concerning food, restaurants and accommodations etcetera.

6% – rate applied concerning newspapers, magazines, travel (taxi, train, bus and train) and concerts etcetera.

0% – rate applied concerning healthcare, social care and some types of education etcetera.

Business administration – guide to doing business in Sweden

Accounting – doing business in Sweden

- Every business is required to maintain accounting. At the end of each financial year, limited companies and companies of a certain size need to file an annual report. Entities excluded from this requirement need to produce an accounting The Bookkeeping Act (Bokföringslagen, BFL) contains detailed directions regarding the records of transactions.

- The accounting standards in Sweden (Swedish GAAP) are developed through the issue of recommendations and guidelines from the Accounting Standards Board (Bokföringsnämnden, BFN), the Annual Accounts Act (Årsredovisningslagen, ÅRL), the Bookkeeping Act (Bokföringslagen, BFL) and the International Accounting Standards Board (IASB).

Annual report – doing business in Sweden

Limited companies and companies of a certain size must produce an annual report. If the limited company is subject to mandatory audit an auditor needs to audit the annual report. The annual report consists of a director’s report, a profit and loss account, a balance sheet and notes to the accounts. Comparative figures from the previous year must be included. The financial statement must be in Swedish, but could be created with a currency of SEK or EUR.

The annual report must be completed within six months after the end of the fiscal year and must be signed by all members of the board.

Audit obligation – doing business in Sweden

A limited company and a branch of a foreign enterprise must appoint an auditor. The auditor must be registered at the Swedish Inspectorate of Auditors (Revisorsinspektionen, RI) and must be either an authorized public accountant (auktoriserad revisor) or an approved public

accountant (godkänd revisor).

However, smaller limited companies can choose not to have an auditor.

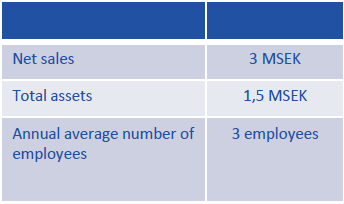

A smaller limited company is defined as a company below at least two of the following thresholds during two following years:

The management audit, that is a separate part of the audit of Swedish companies, is a unique feature in Sweden. In sum, it determines whether a board member or the managing director can be held liable for any loss or damage suffered by the company in question and thus be required to compensate the company.

The audit results in an audit report, which is filed to the Swedish Companies Registration Office (Bolagsverket) making it a public document.

Our company – Revideco AB

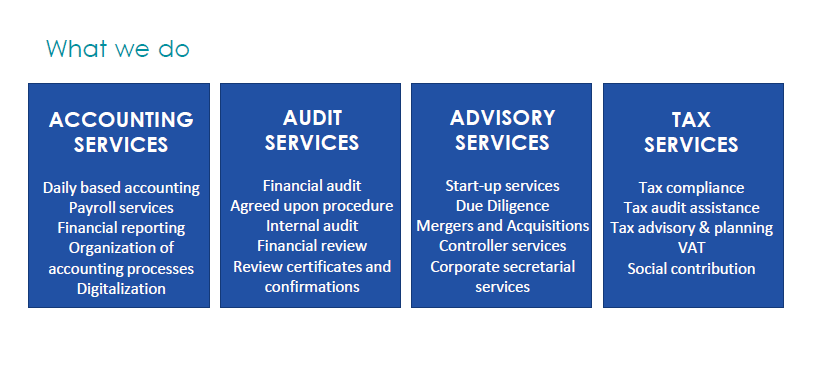

We are an independent and owner-managed multi- service firm in Sweden with the aim to provide added value to our clients. We believe in continuous communication to stay up-to-date with the client’s business and to enable discussions concerning potential problems without delay.

We are about 60 employees in offices covering the cities of Stockholm, Gothenburg, Skellefteå and Sundsvall. Even though we are considered in the same grouping as the big multinational service firms, Revideco AB is different from the big seven. Clients turn to us because of the personal service we deliver and the value for money we offer. We have a large variety of clients, ranging from public listed companies to small entrepreneurs. Yet, our focus is owner- managed, family- and entrepreneurial businessess

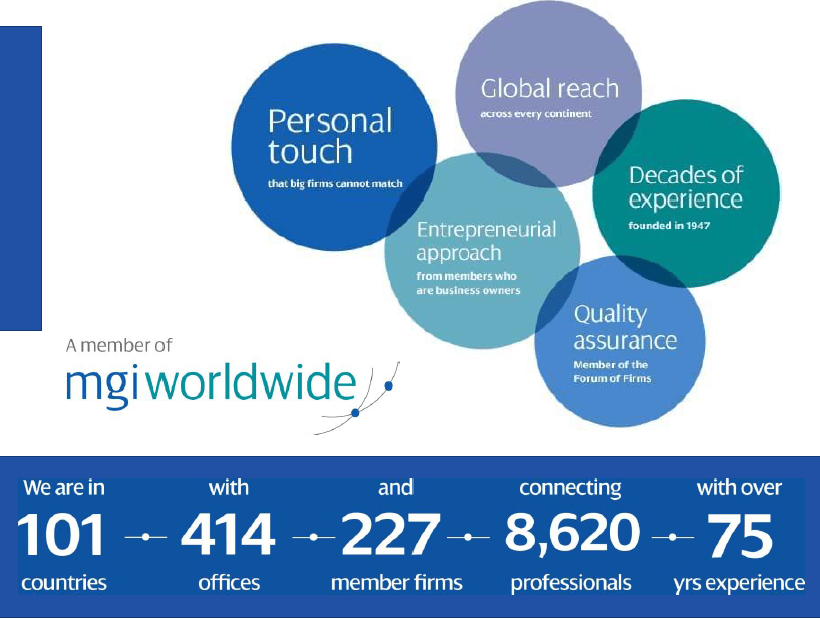

Revideco AB has provided qualified services since 1994 and is an award-winning company of the title – Accounting firm of the future 2019. Our firm is a registered auditing firm and a member of the Swedish Trade Association FAR. Since many of our clients are engaged in international business activities, we are also a proud member of MGI International, an international network of independent authorized audit firms.

International reach – makes a difference!

Through MGI Worldwide with CPAAI, our firm benefits from connections with people we get to know and trust in all corners of the globe, which brings together the expertise of almost 9,000 professionals in some 400 locations around the world.

Our membership enables us to keep abreast of important new developments, while providing a seamless international service to any of our clients looking for support abroad. MGI Worldwide is a quality-controlled network, and, like all member firms, we are subject to review of our quality assurance systems and procedures against international standards.

For more information on MGI Worldwide visit www.mgiworld.com

About MGI Worldwide with CPAAI

MGI Worldwide with CPAAI is a leading top-20 international network and association of almost 9,000 audit, accounting, tax and consulting professionals in some 400 locations around the world.

MGI Worldwide is a leading international network of separate and independent accounting, legal and consulting firms that are licensed to use “MGI” or “member of MGI Worldwide” in connection with the provision of professional services to their clients. MGI Worldwide is the brand name referring to a group of members of MGI-CPAAI, a company limited by guarantee and registered in the Isle of Man with registration number 013238V, who choose to associate as a network as defined in IFAC (IESBA) and EU rules. MGI Worldwide itself is a non- practising entity and does not provide professional services to clients. Services are provided by the member firms of MGI Worldwide. MGI Worldwide and its member firms are not agents of, and do not obligate, one another and are not liable for one another’s acts or omissions.

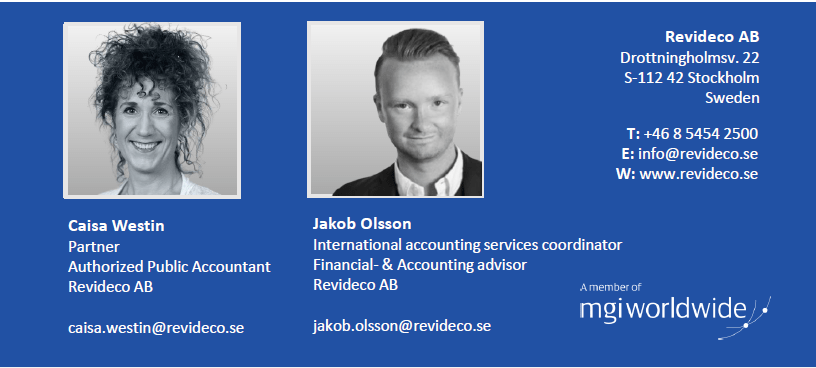

Contact us

Did you find our guide to doing business in Sweden helpful? We sure hope so. If you would like to get in contact with us? Click here.

Disclaimer

The intended use of this booklet ‘A Guide to Dooing Business in Sweden’ is to provide general guidance only. Revideco AB is not responsible for potential errors or omissions in the booklet. Our recommendation is to contact us for professional advice concerning specific situations if needed.

International Accounting Services Coordinator / Financial & Accounting consultant

Phone: +46 8 54 54 25 08

jakob.olsson@revideco.se